Featured Stories

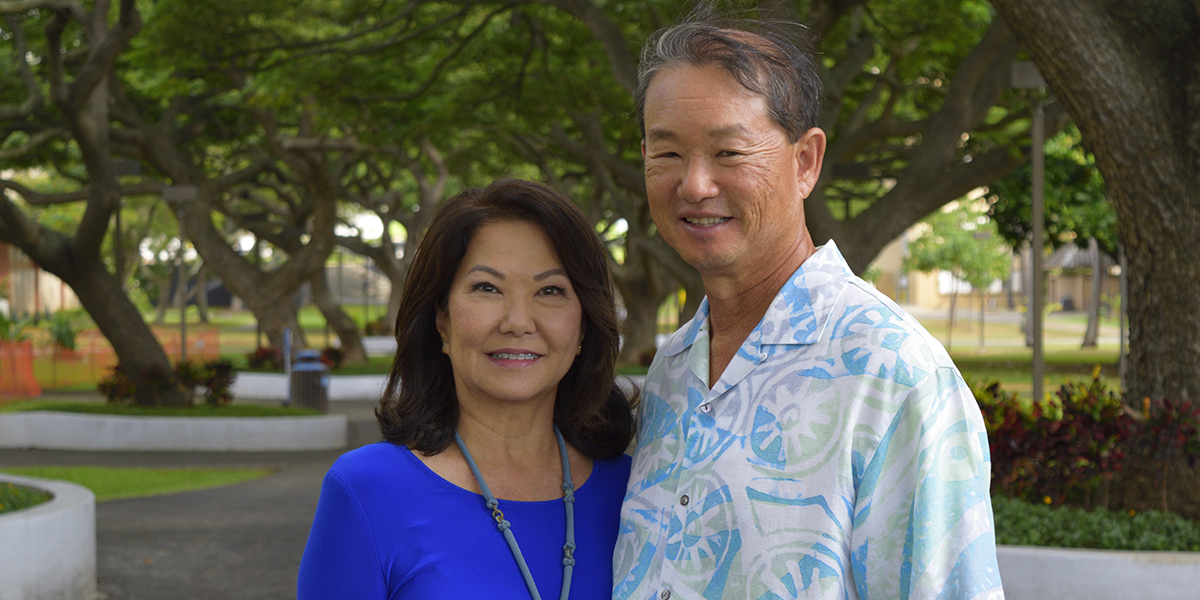

Love story born at UH yields legacy for future nurses, engineers

Ken and Donna Hayashida are making a substantial investment in their alma mater, with gifts totaling $250,000 to the College of Engineering and the Nancy Atmospera-Walch School of Nursing, to ensure other students can get the same quality education they received and to invest in Hawaiʻi's future. » More

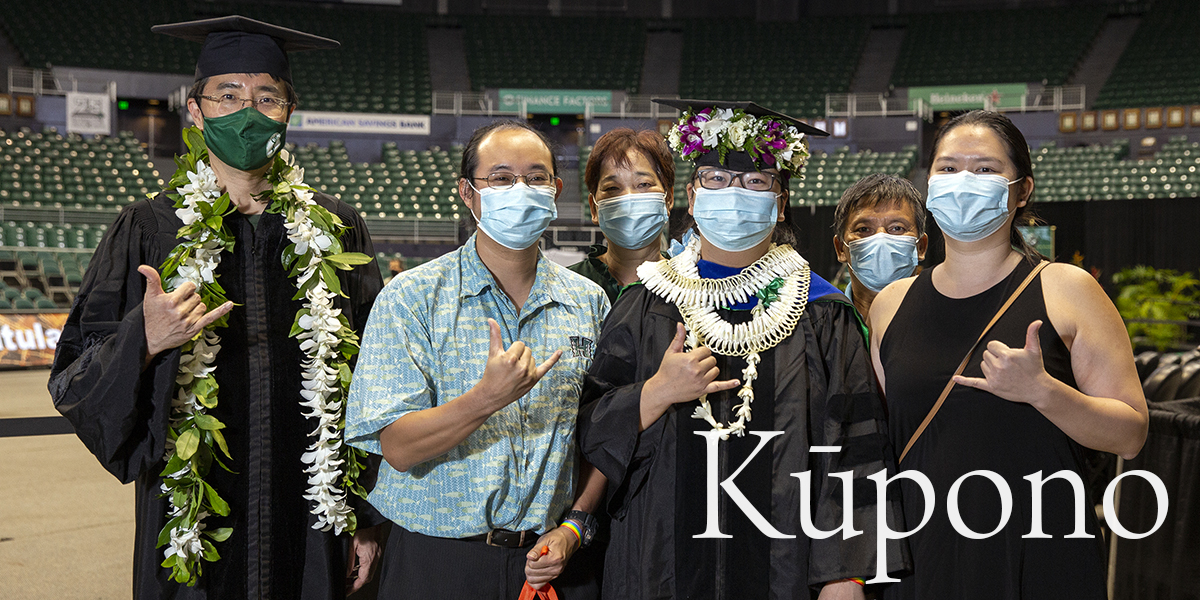

UH Foundation raises $245,639 on second-ever Giving Tuesday

The University of Hawaiʻi ʻohana answered the call to Come Together for the second UH Giving Tuesday.

Year-end tax & gift planning:

Roll over your required minimum distribution

One of the easiest ways reduce tax liability while giving to charity is through a qualified charitable distribution of an individual retirement account. It allows you to donate annual distributions from your IRA accounts to public charities like the University of Hawaiʻi Foundation tax free, even if you don’t itemize your taxes.

Starting at age 72, IRA holders must take a required minimum distribution. These distributions are reported as part of your taxable income.

Congress had suspended the RMD requirement because of Covid-19 in 2020, but the RMD is back in place starting this year, which means some taxpayers could face a larger tax liability.

This is where the IRA charitable rollover comes in, making it easy to give and save at the same time. You don’t even have to wait to turn 72 to take advantage of the benefits — anyone over the age of 70 1/2 may make a distribution from their IRA to a qualified public charity tax-free.

These gifts are beneficial for all donors, especially if you don’t itemize, but they are time-sensitive so it’s best to plan early in the year to maximize benefits.

If you’ve already made your qualified charitable distribution for this year to UHF, please let us know. This way you can rest assured that your gift was received before the end of the year and is being directed to the programs you care about most.

Our Office of Estate and Gift Planning is here to help you make plans for 2022. For more information, please visit our website to download our sample IRA letter, or call us at (808) 376-7873.

Important information about 2021 gifts

As 2021 draws to a close we thank you for supporting our UH students, faculty, programs and research. Your gifts are making an extraordinary impact statewide. We would like to remind you of some important information when making your year-end gifts.