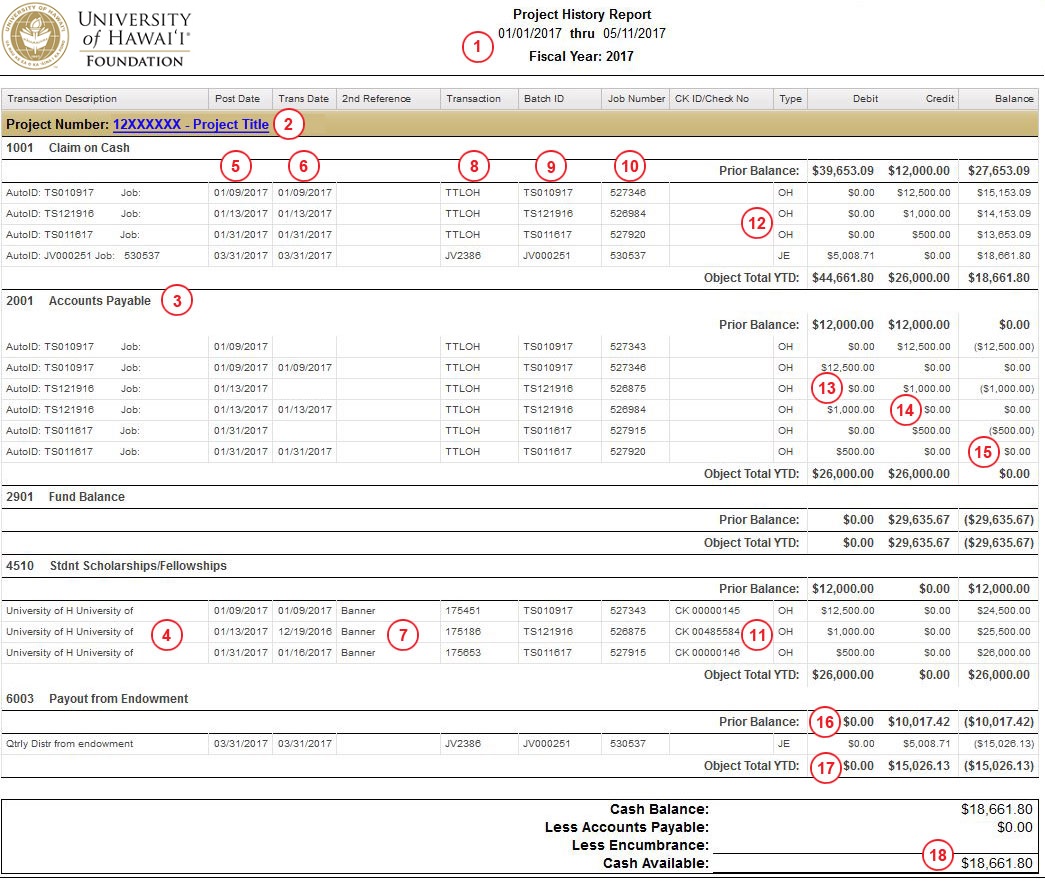

Project History lists transactions for a selected date range. The reports is on a fiscal year basis, provide details of all transactions that have occurred for a given project (account). The Foundation's fiscal year runs from July 1 through June 30.

Account Administrators should review the Project History report each month to ensure that all transactions for the account are accurate. If a transaction is not familiar or is incorrect, please contact the Foundation's Accounting and Finance team immediately.

The report reflects the fund balance as of the beginning of the fiscal year (July 1), all activity during the period of the report and the cash available as of the end of the report period. Activity includes income, disbursements, receivables, payables, transfers between other UHF accounts and investment transactions.

Please note that some of the information generated in the report includes confidential gift and donor information, and should be only be used for university business purposes.

Report Output

| Data Field | Description |

| 1 | Period and fiscal year of the report for which detail transactions are provided. |

| 2 | Project (account) number and title. |

| 3 | Object code and object code description; chart of accounts, transaction classification. |

| 4 | Description of transaction, e.g., donor/payer/payee name. |

| 5 | Date the transaction was posted to the system. |

| 6 | Date of the transaction. |

| 7 | 2nd Reference; document number, purchase order number or transaction number. If you prefer to have the option of including a specific comment (limited to 16 spaces), please contact the Foundation's Accounting and Finance team. |

| 8 | Transaction; journal voucher number or transaction identification number. |

| 9 | Batch ID; posting batch ID. |

| 10 | Job ID; posting job ID. |

| 11 | Check ID or check number. |

| 12 | Type; Transaction type: CR - Cash receipts (gift income) IP/OH - Check disbursement TR - Voided checks JE - Journal entry (contributions and transfers) |

| 13 | Debit; Includes expenses, increases in assets, or decreases in liabilities. |

| 14 | Credit; Includes revenues, decreases in assets, or increases in liabilities. |

| 15 | Balance; Debits minus the credits. |

| 16 | Prior Balance; Balance as of the beginning of the report period. |

| 17 | Object Total YTD; An asterisk next to the bolded balance indicates that the amount listed is the fiscal year-to-date total for that object code. |

| 18 | Cash Available; Unencumbered amount, i.e., cash on hand less accounts payable less outstanding purchase orders. |